Our transportation systems are at a crossroads. With declining revenue because of more fuel efficient vehicles, stagnant gas taxes, and fewer dollars available from state and federal governments, there aren’t enough resources to maintain or build out our local, state and federal transportation networks. And as maintenance is deferred, the costs to repair increase substantially with each passing year. This puts us even further behind.

The main source of funding transportation projects, the gas tax, hasn’t been increased for decades. California last increased its gas tax in 1994. Arizona last changed its rate in 1991 and New Mexico’s hasn’t increased since 1993. During that time inflation has increased by about 70%. As a result, the money generated by gas taxes pays for less and less road work each year.

In California, fuel taxes generate only about 28% of the revenue needed for the state highway system. On an annual basis, that is a $5.7 billion funding deficit (72%) for road repairs on the state highway system alone. Arizona and New Mexico are much the same, with funding shortfalls of 70% and 54% respectively.

All of this is leading, more accurately requiring local (county and city) governments to take control of the funding sources for their local roads and transit systems.

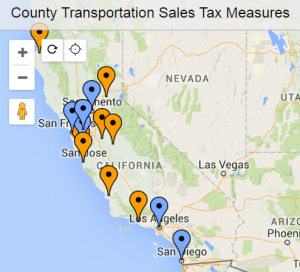

In November, eight California counties and their local transportation agencies are hoping to become “self-help” counties. A self-help county is one that has passed a voter-approved (by two-thirds majority) transportation sales tax measure to fund road, transit, freight and other transportation related projects. Once approved by the voters these monies cannot be used for anything else. And this local money can then leverage even more funds from the state and federal governments.

Currently, there are 20 self-help counties throughout California, representing more than 80% of the state’s population. Another six of those counties are going back to the voters this fall to either extend or increase their existing transportation sales tax.

Collectively, these 14 measures would generate $2 billion for transportation infrastructure repair and maintenance projects on an annual basis.

These efforts are not unique to California. In Arizona, the Pinal (County) Regional Transportation Agency (PRTA) has put a half-cent transportation sales tax to the voters at the ballot box this November.

A lack of investment is hampering rail and transit operators as well. The Bay Area Rapid Transit District (BART) is in need of $9.6 billion for capital improvements over the next decade, but only has the funding for about half that amount. So the district is expected to place a $3.5 billion bond measure on the November ballot. A similar initiative known as Prop 104, was passed by Phoenix voters last August.

As our country celebrates the 60th anniversary of the interstate highway system, we must figure out a way to effectively and sustainably fund the maintenance, repair and expansion of our road and transit systems.

The recently authorized FAST Act creates $305 billion in federal funding over the next five years (through 2020) and is a modest step in the right direction. However, it can’t take another 10 years to create another five year highway bill.

Unless, the political traffic jams in the state capitols and Washington, DC, ease, it looks like more and more local transportation agencies will decide that they have had enough. Or more correctly, they haven’t had enough (of funding) and take the issue directly to the voters at the ballot box.